Tujoromajo Kasuto

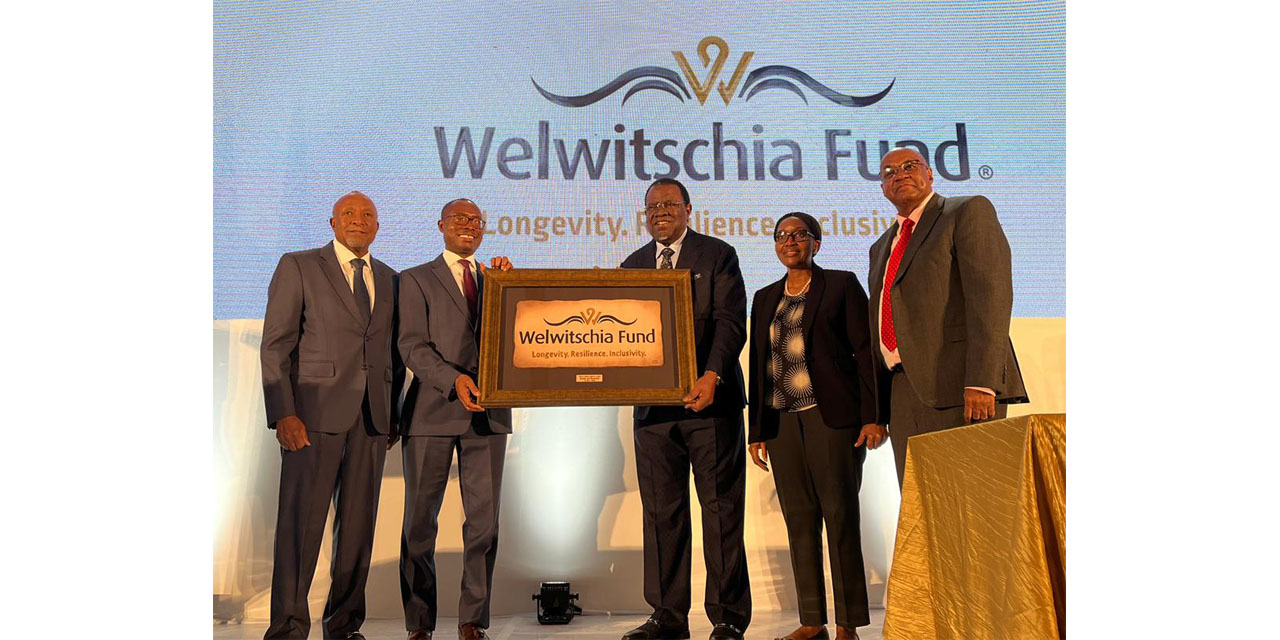

President Hage Geingob has launched the Welwitschia Fund, Namibia’s own Sovereign Wealth Fund today. The fund will be administered by the Bank of Namibia under the Jurisdiction of the Ministry of Finance.

The president immortalised his vision for shared prosperity through the historic launch of Sovereign Wealth Fund, as it will secure generational wealth for posterity.

“I hope today is a day our children will remember with gratitude & national pride b/c we have taken concrete steps to provide a better future for them. A day when we, as a founding generation, leave them a legacy that they will cherish for years to come,” said Geingob.

BoN Governor Johannes !Gawaxab said the creation of the Welwitschia Fund will, without doubt, strengthen Namibia’s fiscal stability and resilience to the external shocks that stem from Namibia’s interconnectedness with the global economy.

‘’The Welwitschia Fund will facilitate the transfer of wealth sourced from Namibia’s abundant natural resources so that generations to come also benefit even long after the current resource base is depleted,’’ he added.

Inspired by Article 95 of the Constitution, the Bank of Namibia is entrusted to manage the newly founded Welwitschia Fund.

The assets of the Welwitschia Fund belong to the Government of the Republic of Namibia and will be independently managed by BoN in consultation with the Ministry of Finance who will act as the representative of the Government.

According to the 2021 Sovereign Wealth Funds Report, SWFs which operated from the wings are now at an all-time high, managing more than US$10 trillion in assets. To put this into context, and by way of comparison, this would make SWFs, on aggregate, the third-largest economy in the world, behind the United States and China.

Thus, !Gawaxab said it is clear from recent data that the size and rapid growth of SWFs is placing them at front and centre stage of public attention.

Thus far, the role of SWFs in the context of the recent turmoil in global financial markets has been notably positive.

‘’If anything, the actions of SWFs have shown that they can play a shock-absorbing role in global financial markets by dampening short-term market volatility and financially aiding countries in times of crises. SWFs stabilise both fiscal outcomes and the balance of payments,’’ said the Governor.

The Minister of Finance Ipumbu Shiimi said the foundation of the Welwitschia Fund is underpinned by two primary objectives and these will be achieved through two separate and dedicated sub-accounts of the Fund, namely the Intergenerational Account and the Stabilisation Account.

The first objective, which will be served by the Intergenerational Account, is saving for future generations. In this regard, Shiimi said the key rationale for establishing the Fund is to promote intergenerational prosperity for all Namibians by ensuring that the distribution of benefits flowing from exploiting the country’s natural resource endowments are shared across generations.

In other words, he says that ‘’a portion of the revenue we collect from the present exploitation of mineral resources for future generations of Namibians to also enjoy the fruits of the resource endowment of their country. The diamonds we are mining today are non-renewable resources, and at some point they will be depleted from our shores’’.

He further asked, ‘’what are we then to bequeath to the next generations of Namibians as a representation that they are citizens of a country that was once blessed with such mineral resources?’’

With the ongoing developments around green hydrogen and oil exploration, he believes, the establishment of the Welwitschia Fund is timely to ensure that they have a solid framework in place to preserve revenues from the present and future exploitation of both renewable and non-renewable resources.

The second objective of the Fund, which will be served by the Stabilisation Account, is fiscal and official reserve stabilisation.

‘’This is borne out of the need to enhance national resilience by insulating the socio-economic structure against cyclical shocks, as well as contributing to the macroeconomic stability objectives. It is important for a country to have fiscal buffers to stave off vulnerabilities arising from business cycles and shocks,’’ explained the minister.

The government declared a national state of emergency on several occasions in recent years, due to drought and the resultant job losses, water scarcity, losses of crops and livestock, and food insecurity, among other significant economic implications.

As a result of these developments, the finance minister noted that the objective of this Fund is to have a buffer, which will ensure the resilience of Government operations in particular and the Namibian economy broadly, against such severe climatic shocks.