CHAMWE KAIRA

The imposition of a 21% tariff on Namibian exports by the United States, as part of a broader protectionist trade agenda, could exert notable pressure on Namibia’s inflation trajectory, Simonis Storm has said.

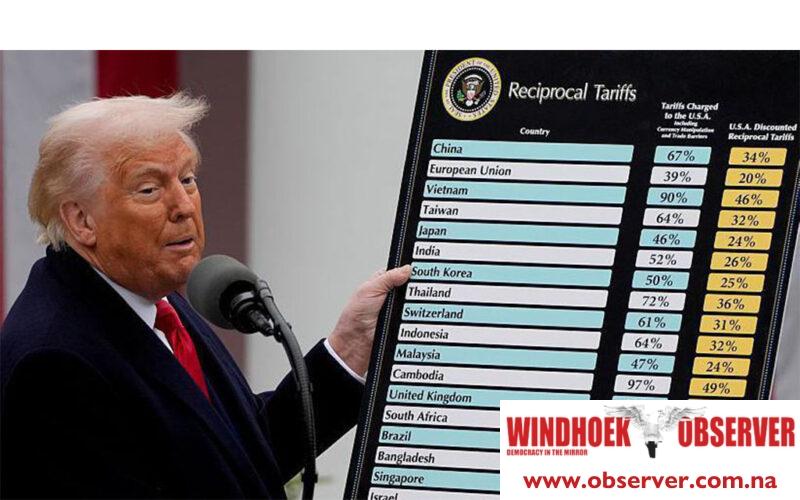

The policy forms part of a sweeping tariff strategy that includes a 10% baseline tariff on all US imports, with elevated rates for specific trading partners, including Namibia.

“Namibia’s key exports to the US, notably diamonds, uranium, and fish, are directly in the crosshairs of these tariffs. A decline in competitiveness in the US market may lead to reduced export volumes, lower foreign exchange earnings, and increased pressure on the local currency,” the firm said.

The firm added that a weaker Namibian dollar would make imported goods more expensive, translating into imported inflation, particularly in essential categories such as fuel, machinery, food products, and consumer goods.

“This exchange rate pass-through effect is likely to be felt in both headline and core inflation, as businesses pass on higher input costs to consumers. Additionally, cost-push inflation could emerge across industries that rely on imported raw materials or equipment. Higher production costs would contribute to price increases across sectors, particularly manufacturing, agriculture, and transport.”

Simonis said in the broader macroeconomic context, uncertainty surrounding global trade flows and investor sentiment could weigh on Namibia’s external position and overall economic growth, indirectly reinforcing inflationary pressures.

The firm stated that in an environment of rising external risks, policymakers may have to strike a difficult balance between supporting economic stability through accommodative monetary policy and managing inflation expectations.

“While the direct impact of US tariffs may be sector-specific in the short term, the broader economic ripple effects, especially through the exchange rate channel, could elevate Namibia’s inflationary pressures in the medium term. Continuous monitoring of trade trends and currency developments will be essential for maintaining price stability.”

When he announced the tariffs, Trump said the decline of US manufacturing capacity threatens the US economy in other ways, including through the loss of manufacturing jobs. He said from 1997 to 2024, the United States lost around five million manufacturing jobs and experienced one of the largest drops in manufacturing employment in history.

Furthermore, he said many manufacturing job losses were concentrated in specific geographical areas. “In these areas, the loss of manufacturing jobs contributed to the decline in rates of family formation and to the rise of other social trends, like the abuse of opioids, that have imposed profound costs on the US economy,” Trump said.