CHAMWE KAIRA

Deep Yellow, which is developing the Tumas Project in Erongo Region, has said the construction schedule has increased from 18 to 24 months and production ramp-up has also increased from six months to a more conservative case of 15 months.

The company said this schedule estimates wet commissioning will be completed within 24 months after Final Investment Decision (FID) decision, with ore processing and production ramp-up commencing thereafter.

Deep Yellow said the first product into drums is anticipated approximately two months after ore processing commences.

“The schedule estimated for Tumas is considered to be conservative and will be a target for further refinement during the ongoing detailed engineering,” the company said.

Importantly, Deep Yellow remains in a strong financial position with a cash balance of A$227 million as at 31 March.

“Even with the anticipated spend on the early works infrastructure and detailed engineering, a group cash balance of A$170-180 million is expected at 31 December 2025.”

Deep Yellow Limited, Managing Director, John Borshoff said Deep Yellow will continue to move ahead with early works infrastructure development and detailed engineering, however full-scale project development will be delayed allowing for what the board believes will be the inevitable improvements in global uranium prices due to increasing demand and the precarious nature of the supply outlook.

“We are at an extraordinary stage in the uranium supply sector. We have a situation where the long-term uranium market is essentially broken. This is due to more than a decade of sector inactivity, persistently depressed uranium prices, and utility offtake contracting practices which are yet to support the development of greenfields uranium production. Although the Tumas Project is economic at current long-term uranium prices, these prices do not reflect or support the enormous amount of production that needs to be brought online to meet expected demand. Also, we can expect from experience that supply shortages will only be exacerbated by likely delays and underperformance of the sector generally.”

He said Deep Yellow is in an enviable position having one of the most rigorously evaluated greenfield projects in the world ready to hit the go button.

Borshoff said the Tumas Project is ready to take the next step but said the consistently stated, a healthy prevailing uranium market is a key prerequisite.

He said there are limited greenfield uranium deposits available for start-up globally over the next 10 years to satisfy projected demand, and new uranium supply will be virtually impossible to achieve in the current price environment.

“Nuclear utilities cannot ignore the fact that unless uranium prices increase to appropriate levels and large amounts of capital become available to the supply sector, those greenfields projects will remain undeveloped. It is against this backdrop that we are comfortable with our decision to carefully progress areas of the project such as early works infrastructure and detailed engineering but not commit the capital to construct the process plant at this time.”

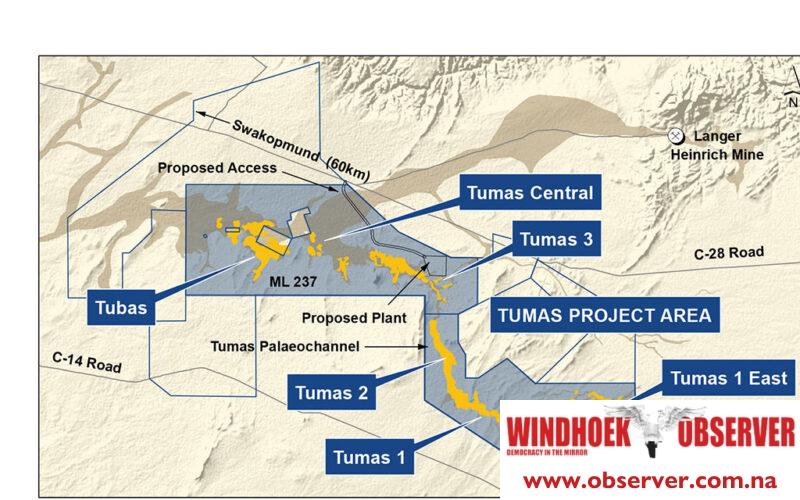

Tumas Project has reserves of 79.3 million pounds of uranium oxide and a US$100 per uranium price for the Tumas deposits. The company said substantial increase in ore reserves confirms that Tumas can support a 30-year life of mine.