Martin Endjala

Homeowners stand to benefit from the increase in the tax threshold from N$50 000 to N$100 000.

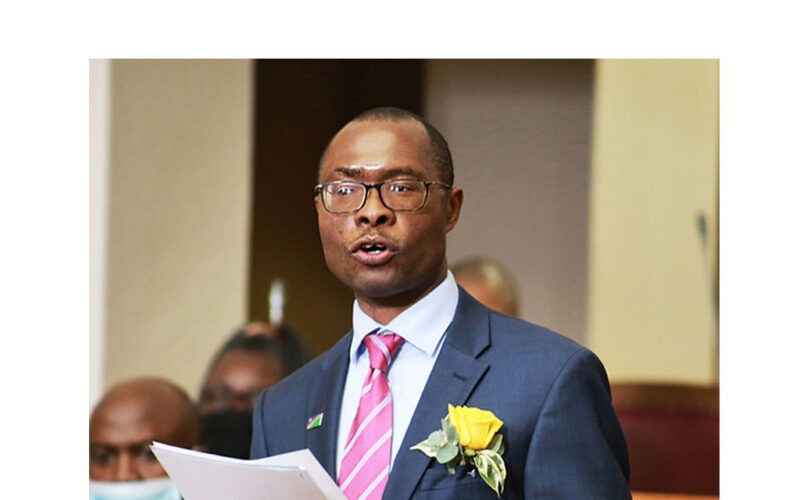

This follows the presentation of proposed amendments to the Income Tax Act, 24 of 1981, in the National Assembly by finance minister, Iipumbu Shiimi this week.

According to Josef Sheehama, an independent bank researcher and economist, homeowners will only have to pay tax on the amount that exceeds N$100 000.

“This is a wise decision, even though government tax revenue will marginally decline. For those looking to purchase a home, this is welcome news because bond costs are expensive,” he said.

As a result, the government has allocated approximately N$646 million to taxpayers, providing an average annual relief of N$12 000 per taxpayer.

Sheehama added that reduced tax rates may incentivise saving and investing, ultimately enhancing living standards.

He added that in many cases, buyers can negotiate for the bond costs to be included in the home loan amount, thus increasing the capital amount if the buyer is obtaining the property through a bank.

If there is enough equity in the property market, this scenario may arise.

“This implies that with changes, homeowners will not be required to pay transfer or stamp duties when they purchase a property for less than N$1.1 million,” he explained.

Sheehama said small and medium enterprises (SMEs) earning less than N$1 million are not required to pay VAT.

He said that this will help SMEs grow and offer expansion opportunities.

The goal of the VAT Act amendments is to lower the cost of conducting business in Namibia.

This measure is beneficial for SMEs as it raises the mandatory registration threshold from N$500 000.

This relief is expected to free up capacity at NAMRA to focus on large taxpayers.

He mentioned that this implies businesses may be able to hire more workers, potentially leading to reduced unemployment rates.

Shiimi said that the amendments will stimulate domestic relief for household incomes, create a conducive environment for businesses to thrive, expand investments, and address certain incidental matters.

“We have considered tax measures to enhance the competitiveness of our tax system to attract more investments and foster a growing economy,” said Shiimi.

He said Namibia is reaping the benefits of a more efficient and effective tax administration, one that is building trust to increase voluntary compliance and boost revenue collections.

“As a resource-rich country, we tap into regional and global developments to achieve both competitiveness improvement and tax base protection,” he explained.

Shiimi said the cost of acquiring residential property continued to climb over time as the cost of building increased.

To support access to housing, the ministry is tabling the transfer duty amendment bill.

“The bill provides relief to those in the property market, the exemption level on property is lifted from N$600 000 to N$1.1 million,” said the minister.

Shiimi announced that the middle brackets in the transfer duty tables will increase from N$2 million to N$3.2 million to further promote property acquisition and achieve a fairer distribution of the transfer duty burden.

A new bracket will be introduced for luxury residential properties valued above N$12.1 million.

Similarly, the Stamp Duties Act will undergo an amendment to raise the entry-level property exemption from N$600,000 to N$1.1 million.

“As an example, on property costing N$3 million, the savings due to the duty rate changes are N$63 200 in duties and another N$98 550 in interest over the lifecycle of a 20-year bond, which is N$161 750. These are significant savings,” said Shiimi.