CHAMWE KAIRA

Osino Resources Corp has announced that it has been finally acquired by Shanjin International Gold of China for cash consideration of 1.90 Canadian dollars (N$25) for each share.

The deal was first announced in February and will see, Shanjin pay 368 million Canadian dollars (N$4.8 billion) to take over Osino.

Shanjin intends to cause Osino to delist the Osino Shares from the TSX Venture Exchange, to submit an application for it to cease to be a reporting issuer, and to otherwise terminate its public company reporting requirements as soon as possible.

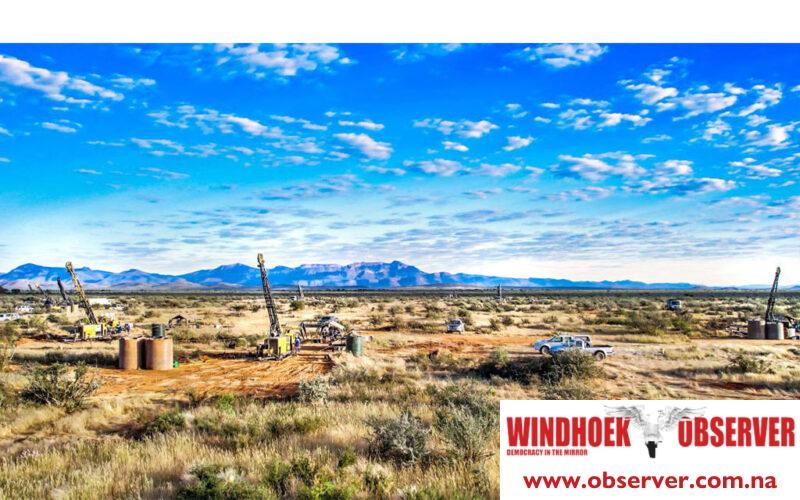

Osino is focused on the fast-tracked development of our wholly owned, Twin Hills Gold Project in central Namibia. Osino has a commanding ground position within Namibia’s prospective Damara sedimentary mineral belt, mostly in proximity to and along strike of the producing Navachab and Otjikoto Gold Mines.

Shanjin International’s 2023 annual report showed that operating income of 8.106 billion yuan, with a net profit attributable to shareholders of 1.424 billion yuan, marking a year-on-year increase of 26.79% and reaching a historic high.

Shanjin said Twin Hills gold mine project is expected to increase gold production capacity by five tons per year upon commencement of production.

“This move marks a crucial step in strategic execution. With the implementation of the new strategy and the commencement of global acquisitions, Shanjin International will continue to deepen internal reforms, enhance operational efficiency, intensify exploration efforts, and expand international markets to create more value for shareholders,” the company said.

At closing of the arrangement, Osino’s portfolio will consist only of gold related assets located in Namibia, primarily the Twin Hills Gold Project in central Namibia as well as exploration projects Ondundu and Eureka.

Prior to entering into the Shanjin agreement, Osino terminated its arrangement agreement with Dundee Precious Metals dated 17 December, 2023.

Heye Daun, President and CEO of Osino, said at that time that whilst the company was appreciative of the previous offer from DPM, the all-cash offer from Shanjin represented a significant premium to the DPM offer price, thus was clearly a superior proposal, and is an excellent outcome for Osino’s shareholders.

Shanjin is experienced, well-financed, and has a highly credible track record of gold mining in China, with the technical skills and financial resources to progress the project through construction and into production, Daun added.

Xingong Ou, President of Shanjin has stated that the Twin Hills represents a unique opportunity to add a high-quality gold development asset to its portfolio in a stable and mining friendly jurisdiction. The project provides the foundation for our future production profile with production targeted for 2026, as well as significant exploration upside, Xingong said.