Niël Terblanché

Reports and statements wanting to create a picture of Namibia being sold out to China by accepting too many loans are factually incorrect and deceptive.

Despite Namibia finding itself in a situation where public debt has reached levels, only a small percentage of the total debt is owed to China.

The country has never owed more than three percent of the total debt to China and the last loan of any significance from that country was given in 2017.

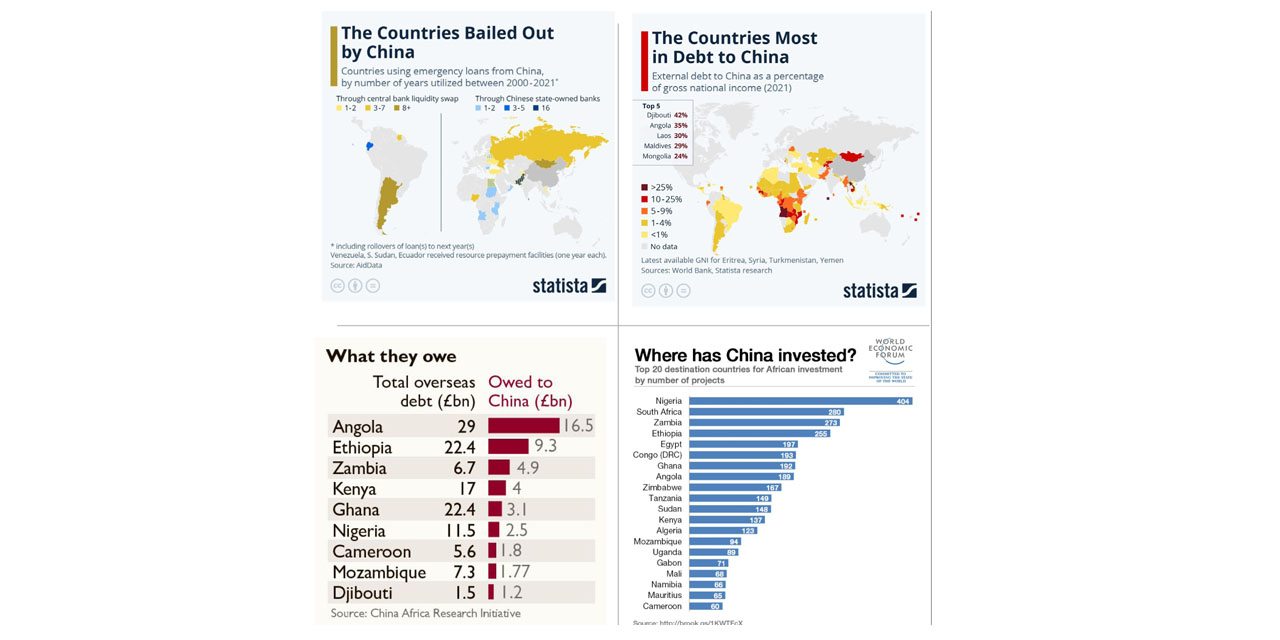

According to the World Economic Forum, Namibia is at the bottom of a list of 20 countries where foreign-funded projects have been run or are currently running. Namibia only has 66 foreign-funded projects compared to Nigeria’s 404 projects at the top of the list.

Statistics compiled by Facilit8 Namibia indicate that the nine countries on the continent with the most debt to China are Angola, Ethiopia, Zambia, Kenya, Ghana, Nigeria, Cameroon, Mozambique and Djibouti. Namibia is not on the list of countries identified by China. Angola owes China N$363 billion which translates into more than 35 percent of its gross national income. Djibouti’s external debt to China bottomed out at 42 percent in 2021.

The same statistics show that no data exists on Namibia’s external debt to China while that country extended debt bail-out measures to Angola, Kenya South Sudan and Ethiopia, amongst others, in the past.

Namibia’s public debt currently stands at N$135.7 billion as of September 2022. The country’s total debt comprises N$101.5 billion domestic debt and N$34.2 billion foreign debt. Namibia owes almost N$2 billion to China in Chinese or Yuan, according to a report compiled by the Institute for Public Policy Research (IPPR).

Bilateral debt is debt owed by Namibia to individual countries such as Germany or China rather than to multilateral institutions and is generally for particular projects or programmes that have been agreed upon between Namibia and the partner country. Bilateral debt is generally owed in the currency of the lending country. The high levels of debt are the result of the government not adhering to its own public debt target of 35% to the Gross Domestic Product set in 2012/13.

According to the report, the government expects the country’s public debt to reach 69.6% of GDP in FY22/23, peaking at 71.0% in FY23/24 before declining somewhat to 69.8% in FY24/25.

The debt, according to IPPR, is composed of Treasury Bills, which is short-term government debt with a maturity of up to a year.

“As such Namibia has four classes of Treasury Bills: 91-day, 182-day, 273-day and 365-day. Together the outstanding amount of T-Bill debt was N$34.5 billion. Others include Index-Linked Bonds (ILBS) which are bonds that pay a rate of return that is linked to the rate of inflation. At the end of September 2022, Namibia had six outstanding ILBS with maturities from 2022 to 2036 worth N$8.7 billion,” the report reads.

Further debt is that of Internal Registered Stock (IRS), which are bonds that pay a rate of return and at the end of September 2022, Namibia had 15 outstanding IRS with maturities from 2023 to 2050, worth N$58.3 billion.

“The total value of T-Bills and bonds outstanding at the end of September was N$101.5 billion. T-Bills and bonds are used to fund the general operations of government and not tied to particular projects, programmes or initiatives,” states IPPR. Multilateral and bilateral debts, according to the report, contribute N$16.041 billion and N$2.602 billion to the hefty debt, respectively. In addition to taking out loans, the government also provides guarantees for loans taken out by public organisations, primarily State-Owned Enterprises or Public Enterprises and these guarantees are required as security by lenders.

In total domestic and foreign loan guarantees are N$2 billion and N$8.1 billion respectively. This amounts to 1% and 4.1% of GDP well below the government’s own target of 10% for all loan guarantees domestically. Foreign loan guarantees account for 80% of all loan guarantees.

These numbers differ somewhat from those included in the main budget in February 2022 where total guarantees were expected to total N$12.1 billion or 6.1% of GDP,” further states the report.

IPPR notes that Namibia finds itself in a situation where public debt has reached levels the government never foresaw. The country’s current Minister of Finance and Public Enterprises Iipumbu Shiimi as well as his predecessor Calle Schlettwein are both on record for saying that debt owed to China is not the biggest slice of the total public debt.

Both ministers have stated repeatedly that the debt to China never rose above three percent of the total debt. When he served as the finance Minister, Schlettwein said that public debt is not necessarily a bad thing, provided that the country maintains the ability to pay back the money.

“With long terms debt, however (20-30 years) the responsibility to pay back is shifted to the next generation. Unsustainable debt levels are those where the future generation is overburdened,” Schlettwein said in 2018.