Niël Terblanché

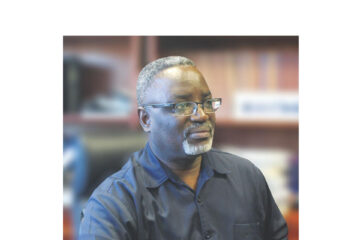

Immanuel Mulunga, the Managing Director of the National Petroleum Corporation (Namcor), is set to appear before a panel of Anti-Corruption Commission investigators to attest to N$270 million that was taken from the state-owned company’s coffers to invest in offshore oil blocks in Angola.

Namcor, as a partner in Sungara Energies, and under the direction of Mulunga has already paid N$170 million as part of a deposit that would give it a working share in three oil blocks off the shore of Namibia’s northern neighbour.

Mulunga has allegedly requested that a further N$100 million be paid towards the deposit because the other partners in the Sungara Energies deal did not pay their share of the deposit.

The Director General of the ACC, Paulus Noa, has confirmed that Mulunga was summoned on Wednesday to appear before a panel of the corruption watchdog’s investigators to give an account of the money spent on the deal.

“We requested Mr Mulunga to bring the relevant documentation and sworn affidavits that should accompany it. He was summoned to hand in the documents still today,” he said.

Contacted for comment, Mulunga confirmed that the ACC summoned him. He did not divulge further information.

According to Noa, the documentation should state clearly that the Namcor Board approved the deal made under Mulunga’s direction. The documentation should also clearly identify the status of the partners in Sungara Energies.

“Mulunga must also give an account with regard to the partnership structure in Sungara Energies and who the shareholders of those companies are, besides Namcor of course,” Noa said.

According to the ACC head, the watchdog is mandated to determine if the money already paid towards the deal is safe and that it can be accounted for.

“We will also have to determine from which fund the money was withdrawn to pay for the investment venture. In Namibia, we have various pools such as the Government Institutions Pension Fund (GIPF) from where the money might be withdrawn and if no account can be given, the loss could have a severely detrimental effect that would directly impact a large portion of the Namibian population,” he said.

Noa indicated that at the moment, only Mulunga would face questioning.

“We might issue additional summonses to some other members of the corporation’s management structure and board if the answers we receive today, are not to our satisfaction. Unless Mulunga can clarify some of the matters of concern, we would definitely question more people to find out if a process of due diligence regarding the partners in Sungara Energies, if at all, was performed,” Noa said.

Sungara Energies reportedly consists of a partnership between Namcor, Sequa Petroleum and the Petrolog Group.

The shareholder deal with Angola’s national oil company, Sonangol, according to Mulunga, had the potential to show profits in excess of N$700 million per year.

Mulunga was quoted saying he had to have the extra N$100 million to avoid losing the shareholding deal with Sonangol.