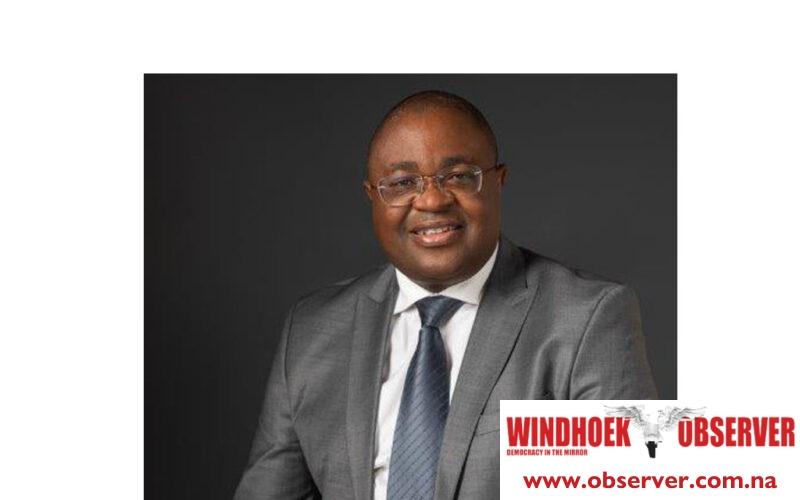

Namibia Financial Institutions Supervisory Authority (Namfisa), Chief Executive Officer, Kenneth Matomola talks about the state of the non-banking financial sector, the state of medical aid industry and new innovations being supported by Namfisa.

Observer Money (OM): How would you describe the performance of Non-Banking Financial Institutions (NBFIs) in the first half of 2024?

Kenneth Matomola (KM): According to the data collected from the NBFI sector by Namfisa, despite the contractionary monetary policy environment, demand for NBFI products remains strong. The NBFI sector remains financially sound and does not pose any systemic risk to the country’s financial system. Overall, the NBFI sector remained sound and stable during the period.

During the reporting period, the macroeconomic environment has been characterised by elevated costs of living and doing business for individuals and corporates.

Revenue collected by NBFIs has remained steady, despite the macroeconomic environment. Thus, demand for NBFI products remains strong for the year to date. Looking forward, the anticipated implementation of the changes to tax laws, as well as the market expectation of no further interest rate hikes for this year, are seen as boosting factors to the demand of NBFI products for the remainder of 2024.

Given that it is an election year for several countries, we anticipate fluctuations in both the financial markets and foreign exchange rates. We however do not foresee that these fluctuations will threaten the viability of the NBFI sector in the short-to-medium term. This is because the largest NBFI subsectors have liabilities with long-term maturities. We similarly do not foresee any immediate threat to the liquidity of NBFIs, in the short-to-medium term.

OM: How stable is the NBFI sector?

KM: Just to re-emphasise, the actual figures will be presented in our imminent publications. Short-term and long-term insurers are well-capitalized, and retirement funds have reserves actuarily certified to be sufficient. Conversely, the viability of medical aid funds has been hamstrung by elevated health inflation rates and higher member utilisation rates. Medical aid funds are being subjected to close monitoring, with solutions being discussed with the relevant industry players. On aggregate, NBFIs are stable and we do not foresee any adverse shocks to the stability of the financial sector emanating from NBFIs in the short-term. Going forward, shocks to the stability of NBFIs include volatility in financial markets; as well as changes in the demand for NBFI products, which is affected by interest rates, inflation rates, and economic development. However, as reported in the 2024 Financial Stability Report, the probability of viability concerns materialising in 2024 are low.

OM: At what stage is Project New Dawn project?

KM: The Project New Dawn it a project under which Namfisa is implementing its three-pronged reform, namely: Legislative, Supervisory, and Institutional reforms. The legislative form pertains to the modernisation of the current archaic financial laws that are ineffective and do not support Namibia’s development objectives, which supervisory reform relates to the moving from ineffective compliance-based supervisory approach to a risk-based approach. The institutional reform was aimed at reconfiguring the structure, system, process, and skill to implement the new legislation and supervisory framework. The project is at an advanced stage considering that the majority of the work that the Authority needed to complete in this regard has been completed. Consultation on the subordinate legislation was completed and all comments and representations received have been considered. Internally the Authority has also commenced with the implementation of Risk Based Supervision. Hence the only deliverables to be completed in the New Dawn project are activities that pertain to post Financial Institutions and Markets Act (FIMA”) and NAMFISA Act operationalisation.

OM: How far is the implementation of the Namfisa Act and what is Namfisa’s contribution to the ongoing consultations on FIMA?

KM: The implementation of the Namfisa Act awaits the implementation of the Financial Institutions and Markets Act (FIMA), which was put on hold for further consultation on the preservation of retirement benefits regulation to be issued under FIMA. The Minister appointed a Technical Advisory Committee to conduct extensive consultations on the preservation of retirement benefits regulation and make recommendations to the minister. NAMFISA has two representatives on the Technical Advisory Committee and their role is the same as any other member of the Technical Advisory Committee, which is to advise and provide input in the recommendations that will be made to the minister.

OM: What is Namfisa’s position on FIMA?

KM: The Financial Institutions and Markets Act, 2021 (No.2 of 2021) (FIMA) is not exclusively focused on the draft regulation on the compulsory preservation of retirement benefits that has received public scrutiny, this regulation has been postponed allowing for broader consultations as mentioned above. This regulation is within Chapter 5 of FIMA.

Namfisa’s position remains that there is a need to reform the legislation to consolidate and harmonise the laws regulating the non-banking financial institutions, financial intermediaries, and financial markets in Namibia. The current legal framework, over 50 years old, is outdated and does not adequately address evolving challenges in the non-bank financial sector.

FIMA addresses governance, prudential, and market conduct issues, emphasizing consumer protection across all supervised sectors. For instance, in the insurance sector, FIMA mandates that policy contracts be written in clear, understandable language suitable for consumers’ literacy levels. It also promotes financial inclusion through micro-insurance regulations tailored to the underserved and unserved population of Namibia.

Furthermore, FIMA enhances member representation on retirement fund boards, empowering workers to influence decisions that protect their rights and benefits. The Treating Customer Fairly (TCF) Standard under FIMA ensures fair treatment of consumers throughout the financial product lifecycle, addressing the root causes of complaints. Despite these advancements, the slow implementation of FIMA poses challenges in effectively addressing sector conduct issues and safeguarding consumer interests.

OM: How will the proposed Financial Adjudicator contribute to the operations of the industry supervised by Namfisa?

KM: The Financial Services Adjudicator Bill has been placed on hold and it’s envisaged to be finalised when the FIMA and NAMFISA Acts come in operation. The envisaged Adjudicator would possess specialised skills and knowledge of financial services which will assist in the speedy resolution of cases. The Bill intended that complaints will be adjudicated with the minimum of legal formalities and at no cost to complainants.

OM: How far has Namfisa gone in implementing the Risk Based Supervision Framework?

KM: The dynamic nature of the financial landscape including NBFIs prompted the authority to embark upon an RBS journey which is a more proactive approach to supervision. The RBS project is part of the Namfisa’s strategic plan under the New Dawn Framework, whose intention was to steer the transition from a compliance-based approach to an RBS approach, to enhance NAMFISA’s supervisory methodology to be risk- and principle-based and forward-looking. By definition RBS is a comprehensive approach with a supervisory emphasis on focusing on what matters and the RBS methodology is premised on 10 core principles.

The authority deemed it fit to launch the RBS project for Namfisa to be abreast with international supervisory trends to enhance its prudential and consumer protection mandate. In terms of RBS implementation, NAMFISA collaborated with the Toronto Training Centre to assist with customisation, testing, and capacity building. As such, after successful pilots of six entities over the past three years (2021 – 2023), in the insurance, capital markets, and pension funds sectors, pilot lessons were used to further enhance the RBS framework, including input from industry before final approval was obtained from the Namfisa board and Minister of Finance and Public Enterprises for RBS implementation. Consequently, the approved RBS framework was officially implemented in the previous financial year ending 31 March 2024 and has since been part of the business-as-usual.

OM: Has NAMFISA seen any innovations being developed so far under the Regulatory Sandbox?

KM: Namfisa has identified digital transformation and innovation as a key strategic theme in its new five-year strategy. As such, Namfisa developed and launched the Regulatory Sandbox Framework to support and contribute to national efforts by embracing and supporting financial inclusion and digital and non-digital financial services innovation.

The primary objectives of the Sandbox are to promote innovation in digital and non-digital financial services, as well as to enhance financial inclusion. It provides a controlled environment under the supervision of Namfisa, allowing for live tests of innovative products, services, or solutions within specific parameters.

The authority launched the Regulatory Sandbox in the 2022/23 financial year and received ten applications for the first cohort of microlenders. Of these applications, three were market-ready to participate in the regulatory sandbox, while only two innovators were officially admitted in the sandbox, namely ReferredBy and Verime. In addition, to drive the uptake and sustainable fintech innovation, it is crucial to bridge the gap between academia and industry.

OM: Give us a progress report on the Consumer Credit Bill (CCB)?

Consumer protection is at the heart of the newly proposed Consumer Credit Bill (CCB), which seeks to protect consumer interests, ensure responsible lending practices, and establish effective mechanisms for recourse in cases of disputes. This legislative initiative aims to foster fairness, transparency, and accountability in the consumer credit market. The CCB represents a significant step towards consolidating and reforming credit laws to better serve consumers. Public consultations, conducted across all regions of Namibia, have been integral in shaping this legislation, with input from stakeholders crucial in refining its framework.

Targeted information sessions have been held for the NAMFISA employees, the Ministry of Finance and Public Enterprises, and the media, while wider public consultations have taken place in all 14 regions of Namibia between June 2023 and December 2023. Additionally, the team presented at the Regional Governors’ Forum in Gobabis in November 2023 and participated in a workshop with the World Bank in March 2024 to discuss their draft Peer Review Report. The authority will incorporate feedback received to finalize the draft Bill, ensuring it meets the needs of both consumers and industry stakeholders. The revised Bill will undergo review by the CCB Steering Committee before submission to the Minister of Finance and Public Enterprises by December 2024. It is worth noting that the timelines are dependent on the volume and complexity of the comments