CHAMWE KAIRA

FNB Namibia economist Helena Mboti is of the view that inflation will remain elevated but relatively contained.

“We expect transport inflation to stay muted amid subdued demand and ongoing geopolitical uncertainty. However, housing and utilities inflation is likely to remain high because of the expected increase in electricity tariffs in 2025,” she said.

In 2024, the government subsidised NamPower’s proposed 8% electricity tariff hike, allowing electricity costs to remain unchanged for the year..

Mboti said as a result, NamPower is likely to propose a larger tariff increase in 2025 to recover deferred costs.

“We also expect continued pressures from house prices. Therefore, while the March figures reflect a notable upward surprise, we continue to project inflation to remain anchored around 4% in 2024. However, we have marginally increased our April forecast to 4.2% and revised our 2025 average inflation forecast to 4%, up from 3.8%.”

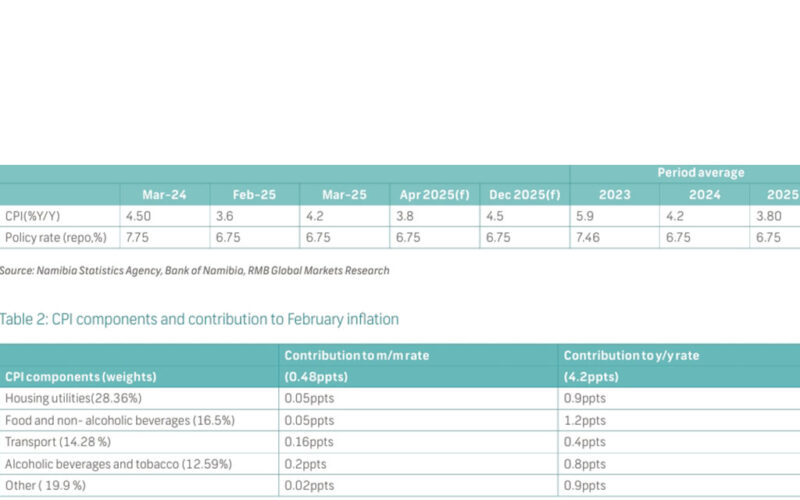

Headline inflation climbed to 4.2% year-over-year in March from 3.6% in February, driven by higher food, housing, transport, and alcohol costs. On a month-on-month basis, inflation increased from 0.4% in February to 0.5% in March.

“Given the notable upward surprise in core inflation, we have revised our April headline inflation forecast to 4.2% and this year’s average headline inflation projection to 4%, up from 3.8% previously.”

Mboti said the upside in inflation surprise was primarily driven by a sharper-than-expected increase in alcohol prices, while strong contributions from food and housing and utilities categories were broadly in line with expectations.

Food inflation remained the largest contributor to headline prices, with prices rising marginally to 6.2% year on year from 5.9% in February, pointing to continued price pressures in the agricultural sector. Similarly, the housing and utilities category edged up to 3.8% from 3.6%, largely due to higher electricity and gas costs.

Inflation in the transport category accelerated to 2.6% year on year from 1.3%, likely driven by rising prices in the vehicle purchase sub-category, possibly linked to stronger demand for vehicles.

“As a result, the transport category contributed double the prior month’s contribution. This increase reflects ongoing input cost pressures, tax hikes, and elevated global supply chain disruptions in March 2025, in line with the 50-cent increase on both petrol and diesel prices,” Mboti said.