The 2024/25 financial year borrowing plan released by the Bank of Namibia outlines a net financing need of N$15.3 billion for the financial year, including a significant Eurobond maturing in October 2025.

The Bank of Namibia plans to source funds primarily through local government debt securities and external debt financing.

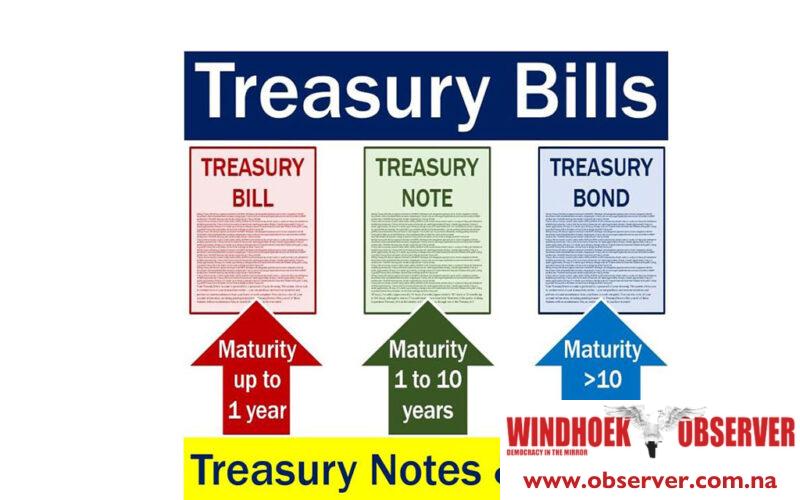

The strategy includes raising N$12,8 billion from the domestic market, N$8,8 billion from fixed-rate bonds, N$2,9 billion from Treasury Bills (TBs), and N$1,1 billion from inflation-linked bonds.

“A new fixed rate bond may be issued later in the year. If the domestic target is not met, a JSE-listed fixed-rate bond will be issued to cover the shortfall. The GC26 bond offerings will be suspended in September, and GC27 offerings will be re-opened. Switch auctions for GC24 and GC25 will allow bondholders to move to longer-dated bonds at higher yields,” Simon Storm Securities commented.

Additionally, N$2,4 billion will be sourced externally from the African Development Bank and Kreditanstalt für Wiederaufbau (KFW). The funds sourced from both parties are project-based, with the facility extended by the African Development Bank of N$1,7 billion being issued at a floating rate equivalent to the JIBAR. The loan terms on facilities extended by KFW range between 10 to 15 years, whereas the funding from the African Development Bank extends up to 20 years with a 5-year grace period.

“Given the anticipated reduction in interest rates by 25 basis points and easing inflation, significant impacts on the local bond market are expected. Lower interest rates will likely lead to a decrease in bond yields, particularly for fixed-rate bonds, making their fixed interest payments more attractive and causing yields on new issues to drop. This environment will also boost the prices of existing bonds, benefiting current bondholders through potential capital gains,” Simonis said.

Simonis said considering its expectation of an initial interest rate cut towards the end of this year, followed by further declines next year, it would be prudent to extend bond durations slightly. The firm added that longer-dated bonds like the GC30 and GC40 could present attractive investment opportunities.

“These bonds are likely to offer stable returns over a longer period, providing a buffer against further interest rate reductions. Additionally, there might be an undervaluation in mid-term bonds like the GC27, which, given the expected interest rate environment, could offer significant value and potential for price appreciation as the market adjusts to the new rate landscape.”

Simonis noted the government’s strategic move to reopen the GC27 bonds and introduce new longer-term bonds aligns with these trends, providing attractive options for investors while helping to smooth out the redemption profile and manage interest rate risks.

It expects the yield curve to flatten, with yields of Treasury Bills decreasing more significantly in response to the interest rate cut, and long-term yields reflecting reduced inflation expectations.

“Moreover, the government’s borrowing strategy, which emphasizes domestic borrowing for approximately 84% of financing needs, will effectively mitigate foreign exchange risks. By borrowing predominantly in local currency, the government avoids the potential escalation of debt servicing costs associated with exchange rate fluctuations.”