Martin Endjala

The Bank of Namibia wants credit decisions taken in Namibia in order to ensure a banking sector system that works for the people of the country.

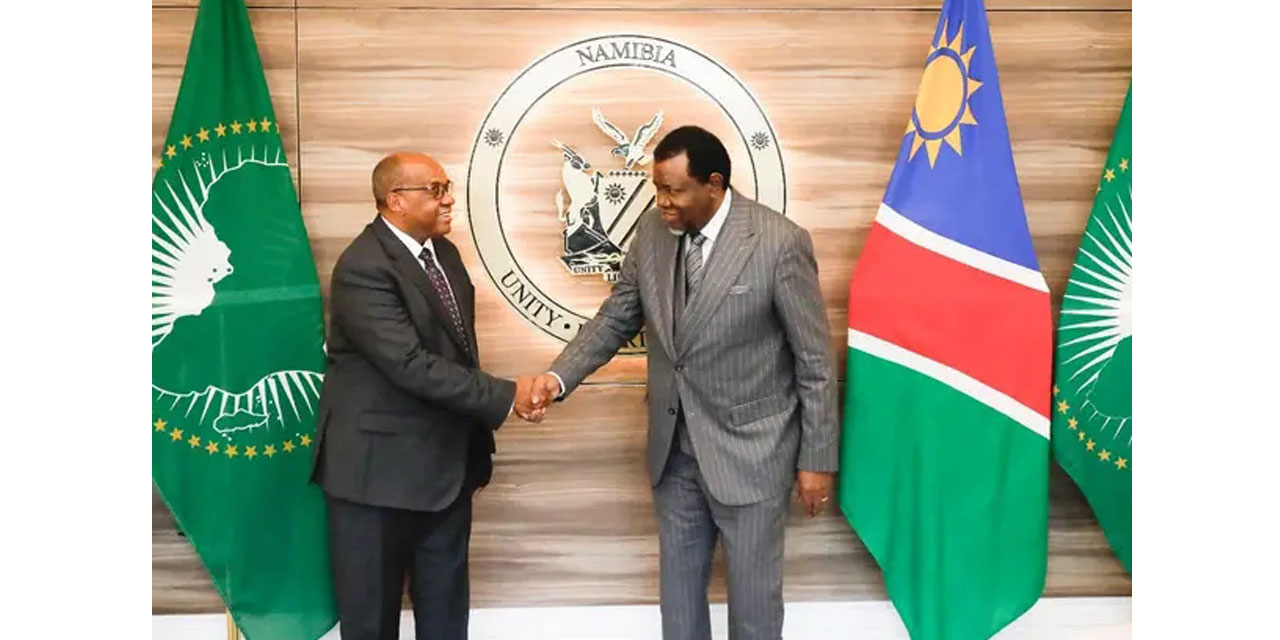

Johannes !Gawaxab, the Governor of the Bank of Namibia made the statement following a courtesy meeting with President Hage Geingob at State House on Tuesday. The visit to the State House was to provide the Head of State with the BoN’s annual briefing on issues of economic concern.

“We want a banking sector system that works for Namibia. We want decision-making to be centralised and happening in Namibia,” !Gawaxab said.

He stated that the private sector credit extension in the country currently, is estimated at two to three percent. Last year it was at three percent and it has been high in the previous years as well.

!Gawaxab says there is currently a situation where credit extended to Namibian households, individuals and SMEs businesses are pretty low.

“We are granting licenses to the banks to offer credit. In as much as we are responsible for the stability and soundness of the banks. We want credit decisions to be taken in Namibia,” he said.

The Governor stressed that he wants these credit decisions taken by people that the BoN has authorised.

“This is why the central bank wants to change the law so that they are able to take credit decisions in the country so that governance control resides in the country,” he said.

High banking charges have been a cause of concern for many Namibians and feature in the central bank’s annual report as a key complaint that consumers of commercial bank services lodged with the BoN.

!Gawaxab also indicated that the appointment of the Financial Intelligence Center Director is well on track and the Council is expected to meet in early August where a final decision will be made.

“The appointment of the FIC director has advanced pretty far. All we really need to do is to inform the FIC council formally and their meeting is in August. Once the council is informed, we can announce the appointment of the FIC Director,” he said.