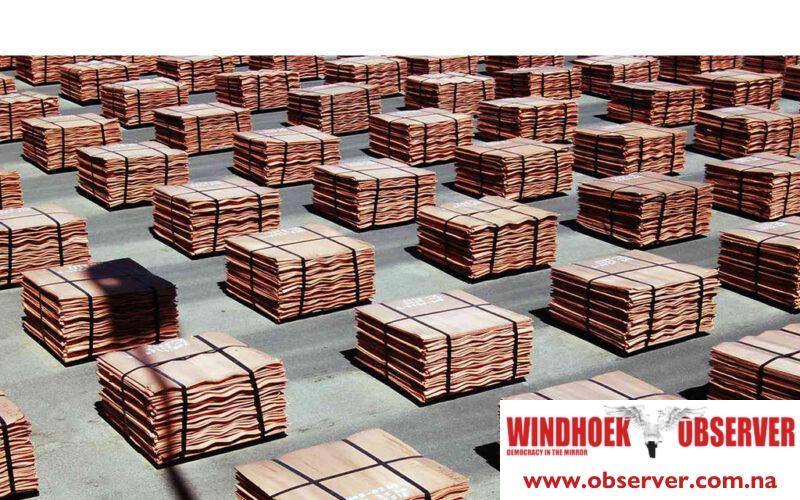

The prices of copper and zinc declined, while that of gold increased in 2023 over 2022. The average price of copper dropped by 3.8% to U$8490 per metric tonne in 2023.

This was on the back of declining demand, especially from China. Meanwhile, zinc prices dropped by 23.8% to an average of US$2653 per metric tonne in 2023, chiefly attributed to weak demand, notably from China, Bank of Namibia statistics showed this week.

On the positive side, the gold price increased by 7,9% to an average of US$1943 per ounce in 2023, mainly on the back of safe-haven demand driven by the Israel-Hamas war.

According to the International Diamond Exchange diamond price index, there was an 18,2% decrease, with the index averaging approximately 97,42 points.

The central bank said the weakening consumer demand for polished diamonds in the US and China contributed to the downturn in the diamond market. The US, which represents the largest market in the industry, faced challenges due to increasing inflationary pressure. Additionally, China, a key growth market, experienced a real estate crisis that negatively impacted consumer confidence.

Furthermore, the diamond market also faced an oversupply issue because of people stockpiling goods during the pandemic and choosing to purchase diamond jewellery and other luxury items while staying at home.

“To exacerbate the situation, the lab-grown diamond industry made significant advancements in certain crucial sectors, thus constituting formidable competition to the natural diamond sector,” the Bank of Namibia said.

The price of uranium increased by 25,5%, reaching an average of US$62,51 per pound in 2023.

This increase was largely attributed to strong demand for energy security, as well as China’s growing need for uranium in its nuclear projects.

Additionally, the decision made by uranium producer Cameco to reduce its production has continued to support the price of uranium.