Niël Terblanché

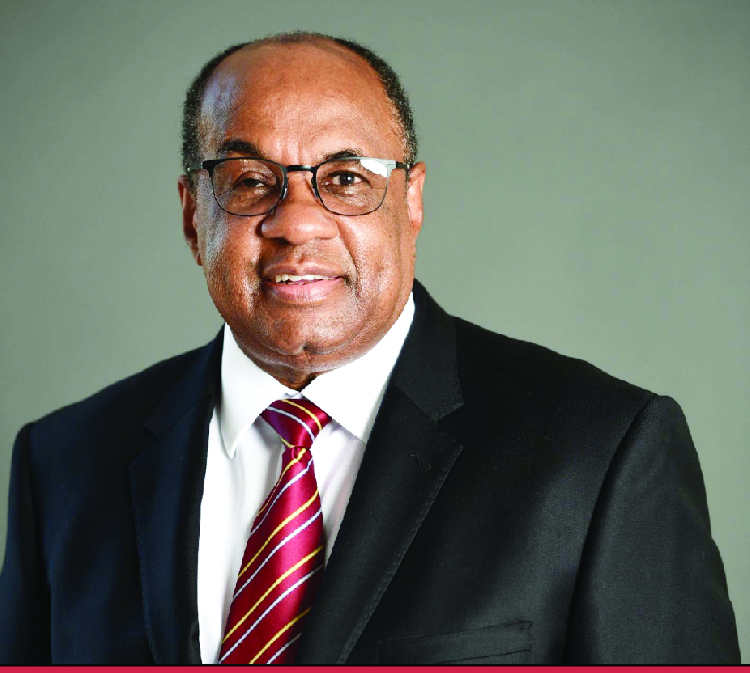

The Namibian Competition Commission fined Johannes !Gawaxab, the Governor of the Bank of Namibia (BoN), and two others for failing to properly notify relevant authorities about a business transaction that violated the country’s merger control regulations.

The penalty, amounting to N$1 million, also shed light on !Gawaxab’s prior business dealings have continued to attract scrutiny after his ascent to one of the country’s top financial posts.

Before his appointment in 2020, !Gawaxab was a distinguished figure in the business sector, known for his roles across various African countries with Old Mutual and as CEO of EOS Capital, a Namibian private equity firm.

When the late President Hage Geingob appointed him as the governor of the central bank, he divested from EOS Capital to avoid potential conflicts of interest. !Gawaxab, Ismael Gei-Khoibeb, and Gamma Investments fell foul of regulatory requirements.

According to the Competition Commission, the trio failed to notify the authority about the transfer of shares, a significant oversight given the scale of the transaction, which involved entities collectively valued over the regulatory threshold.

The investigation into this transaction reveals deeper concerns about governance and compliance in the interlinked worlds of Namibian business and politics.

Gei-Khoibeb acquired !Gawaxab’s shares in EOS Capital before he was appointed the governor of the central bank.

The Competition Commission criticised the move for its procedural lapses but also for its potential implications for fair competitive practices in Namibia.

Gawaxab’s leadership roles have ranged from chairing major corporations to parastatals like Namcor and the Social Security Commission, demonstrating a longstanding influence on Namibia’s economic landscape.

The Competition Commission claims that the fine it imposed serves as a stark reminder of the regulatory vigilance required to uphold transparency and fairness in public officials’ corporate dealings, particularly in a nation attempting to strike a balance between economic advancement and equitable governance practices.

In response to the fine, !Gawaxab noted that while the agreement with the Namibian Competition Commission to ensure compliance was pragmatic and not an admission of guilt, it was necessary to avoid a protracted legal battle.

“The parties involved are now mandated to implement a compliance programme to align the deal with competition laws. The settlement was formalised by the High Court on 30 April, marking a legal end to the oversight,” he added.

A statement from Eljota Investments stressed that !Gawaxab had taken proactive steps to divest his interests, including in EOS Capital, to prevent any potential conflicts of interest upon his appointment as BoN governor.

Eljota Investments stated that the urgency of his appointment did not allow for the completion of standard valuation processes, including notifying the Competition Commission about the share sale, due to the complex and time-consuming nature of the procedure.