This week, Kazembire Zemburuka, Director of Strategic Communications and International Relations at the Bank of Namibia addresses the current hot topic were commercial banks have been accused of making super profits and having high bank charges.

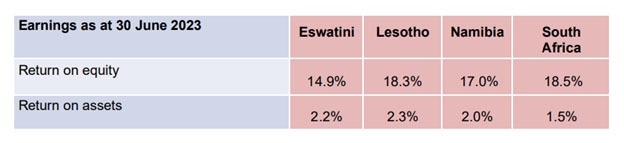

Observer Money (OM): In terms of the most talked about banks in Namibia being accused of making

excessive profits, how do the profit margins in Namibia compare to other countries in SACU, SADC and Africa in general?

Kazembire Zemburuka (KZ):

OM: Members of Parliament both ruling and opposition support the view that bank charges in Namibia are high, does BoN think this view is based on a lack of understanding?

KZ: The Bank of Namibia acknowledges the widespread concern regarding banking fees and charges. Therefore, prioritising the existence of robust laws to enable regulatory interventions for overseeing fees and charges has been a focal point for both the Bank and the Ministry of Finance and Public Enterprises.

To this end, the Bank and the Ministry advocated for legislation authorising the Minister of Finance and Public Enterprises to issue regulations governing fees and charges imposed by banking institutions on their customers.

The recently enacted laws, namely the Banking Institutions Act no. 13 of 2023 and the Payment System Management Act no. 14 of 2023, specifically address the issue of fees and charges, ensuring that decisions are made in the best interest of all Namibians.

With the enactment of these new laws, a revised regulatory framework has been established to address the matter, including the identification of certain fees and charges as unnecessary and the requirement for commercial banks to justify fee increments. While these mechanisms play a crucial role in supporting Namibians and economic activity, it is important to emphasise that bank profitability is essential for the overall stability of the financial system. This necessity must be balanced with considerations of financial inclusion and access.

OM: In terms of banking charges, how do the charges in Namibia compare to other countries in SACU, SADC and Africa in general?

KZ: The Bank does not have data pertaining to fees and charges imposed on customers in other countries in Africa. However, the bank has noticed that some countries in Africa have developed regulatory frameworks to regulate fees and charges.

Regulations in these countries have adopted mainly three approaches namely: prohibition of certain fees, introduction of price ceilings to curtail price increases and approval of price adjustments by the Central Bank. In choosing the most preferred approach for Namibia, consideration should be made to the interest of consumers, the interest of banking institutions and the public interest to ensure continued stability and competitiveness of the banking system.

OM: How does the Bank intend to address this issue going forward, are you going to engage stakeholders or carry out educational campaigns?

KZ: Following the enactment of the aforementioned Acts, the Bank of Namibia initiated discussions with commercial banks, focusing on key issues and highlights introduced in the acts. Central to the conversation were effective governance, transparency, and accountability, with a particular emphasis on the matter of fees and charges.

The implementation of these new laws is crucial for establishing a robust and stable financial system that operates in the best interests of all Namibians. Consequently, banks are mandated to transparently disclose fees and charges to their users, promoting openness and clarity.

To enhance access to financial services, the Bank has mandated the provision of a basic bank account, free of certain charges for low-income individuals, and the elimination of cash deposit fees at all commercial banks, among other interventions.

Additionally, on an annual basis, the Bank releases a fees and charges comparison report, providing customers with information on the fees associated with various transactional services offered by financial institutions in Namibia.

OM: How stable is the Namibian banking industry going by international benchmarking by agencies like IMF, Fitch and others?

KZ: The financial sector remains stable and sound, with adequate capital and sufficient liquidity to withstand shocks. The industry recorded earnings despite the aftermath of COVID-19. One risk being monitored closely is credit risk, especially non-performing loans due to the impact from high level of interest rates and high inflation.