30

Oct

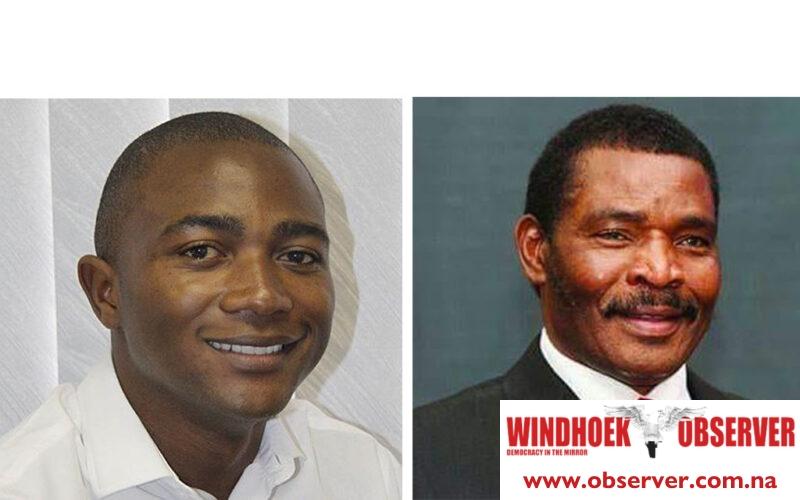

Stefanus Nashama Workers are increasingly turning to social justice activists for help with labour-related issues, citing frustration with the policies of the Ministry of Labour, Industrial Relations and Employment Creation. Sakaria Johannes, a political analyst, said the government system has many flaws and is riddled with many loopholes that make resolving labour disputes ineffective. Johannes shared this with the Windhoek Observer this week. “Sometimes, those who are at the top are the cause of labour issues, which make it easy for them to manipulate the system,” he said. Johannes added that many workers are reluctant to report labour problems for…