Erasmus Shalihaxwe, Martin Endjala and Hilarius Hamutenya

There are increasing calls for the exemption of essential food items from Value Added Tax (VAT) to ease the financial burden on households.

The call by independent bank researcher and economist Josef Sheehama is part of broader efforts to address the country’s high food inflation rate.

“Namibia should establish a commodity taskforce and exempt essential food items from VAT. This will relieve pressure on households, particularly those residing in informal settlements,” he said.

He suggests establishing a national task force on commodities to regulate food prices and provide subsidies to small-scale farmers.

Sheehama also recommended initiating an investigation into effective agriculture models to reduce the high rate of food inflation.

In a case study, a single-person household’s monthly costs in Windhoek range from N$4 000 to N$5 000 on average.

The average monthly expenditure for a married couple without children is N$7 000.

A family of five spends, on average, N$8 000 to N$9 000 on expenses per month, depending on the age of the children.

Sheehama added that, depending on banks, it would take N$1500 per person for food when individuals apply for credit and complete their income and expenditure statements.

This sum does not include other monthly responsibilities like water and electricity, to mention the necessities.

“Keep in mind that this is what the typical Namibian spends each month, not necessarily what you should spend. The precise percentages you set aside for your budget must make sense given your income, lifestyle, and priorities. Having a budget enables you to plan ahead for each monthly expense. It also indicates areas where you can reduce expenses to increase your margin,” said Sheehama.

He added that when homeowners spend more than 30% of their income on housing costs, it’s taken into consideration.

Whether it’s because of high interest rates or because they’ve simply decided to live beyond their means,

According to the widely accepted 25% to 30% rule, homeowners should not spend more than 30% of their monthly mortgage.

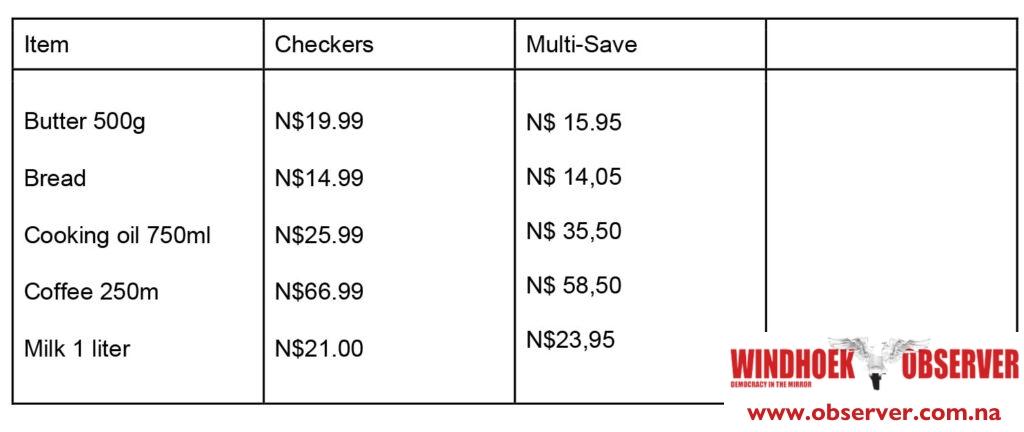

This week, the Windhoek Observer sampled the prices of five random cheap food items around Windhoek.

According to official opposition leader McHenry Venaani, the high cost of living threatens everyone’s dignified livelihood because it exacerbates an already high multidimensional poverty index.

“The evidence is now further outlined through the continued rise in consumer prices. This means that curbing the problem will require decisive and multi-pronged interventions. Chiefly, at the very top of economic policy should be strategies that increase internal production and reduce over-reliance on imports for food and other complementary goods,” he urged.

Venaani believes this would consist of a reinvigorated approach to agriculture, investment in modern farming techniques and support for food production so that it is not at the mercy of global supply chains and price volatility.

“Equally necessary is the need to address deep-lying structural factors that feed into inflation, among them limited domestic production, high import costs, and bottlenecks in the energy sector. Such a corrective approach would be premised around a broad, multi-faceted response entailing strategic reforms, investment and resultant policies with effectiveness in resolving the causes of these issues,” explained Venaani.

He advised that it is also important to review and where necessary adjust the current monetary policy framework.

Among these would be the need to review measures such as inflation targeting for appropriateness and efficacy within the Namibian context.

This ensures nuanced and agile approaches to monetary policy, according to him.

Venaani proposed that the government should minimise uncertainty through evidence-based policymaking to safeguard the welfare of its citizens.

“This is necessitated by the fact that such approaches would greatly support economic stability,” he added.

According to recent reports, the cost of living in the Khomas region has increased by 5%.

The report highlighted that the increase in prices for essential goods and services such as food, transport, housing, electricity, gas and other fuels is quite distressing and requires immediate attention from the authorities.

Kavango West and East, Ohangwena, Oshana, Omusati, Kunene, and the Otjozondjupa regions, are closely following behind with a 4.6% increase.

This, according to Venaani, is an indication that this is not a localised issue, but rather represents a nationwide hindrance to the quality of life for Namibians.