The value of Russia’s rough-diamond production surpassed Botswana’s for the first time in 2023 even as sanctions and a weak market hindered the country’s diamond sales.

The growth comes despite increased sanctions, including the addition of the European Union to the list of those banning Russian diamonds and harsher rules by the US regarding goods substantially changed in a third-party country, such as India.

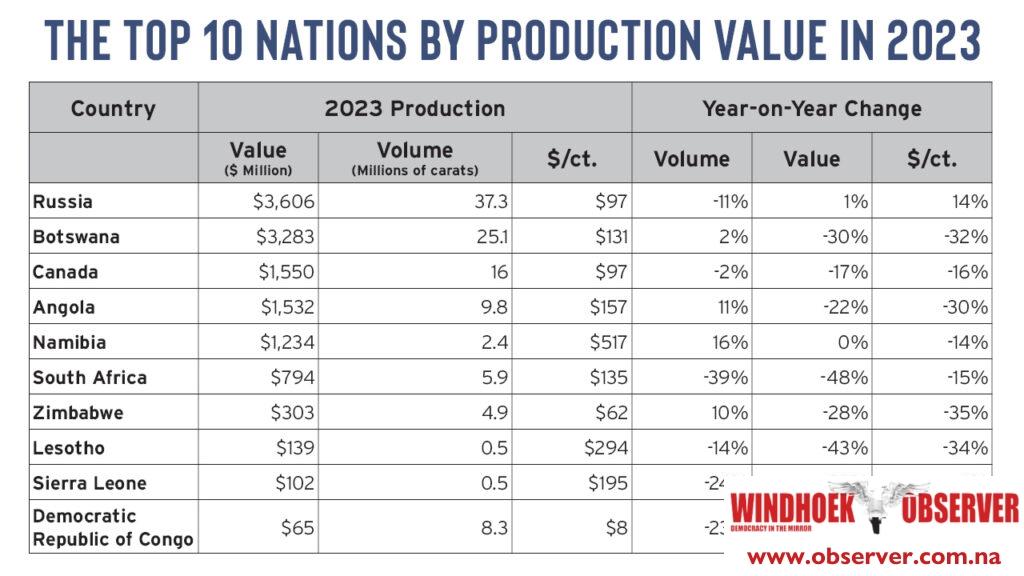

Last year, Russia produced 37.3 million carats of rough, with a total value of US$3.61 billion, at an average price of US$97 per carat, according to statistics the Kimberley Process (KP) in its production report.

That compared to 2022 output of 41.9 million carats with a total value of US$3.55 billion, and an average price of US$85 per carat. Meanwhile, the value of production at Botswana’s mines slid, possibly due to a lower available output mix at De Beers’ Jwaneng deposit, which is in the middle of an expansion.

In 2023, the country produced 25.1 million carats, with a total value of US$3.28 billion, at an average price of US$131 per carat, while in 2022 output of 24.5 million carats was valued at US$4.7 billion, with the average price set at US$192 per carat.

Global rough output fell 20% year on year to US$12.72 billion. By volume, production slipped 8% to 111.5 million carats. Total imports dropped 10% by volume, while global exports were down 9%.

The decline in exports reflected a 12% slump in the number of carats exported from Russia, a 24% drop from Botswana, and a 45% decrease from South Africa.

Last month, the European Union has extended the sunrise period for sanctions on Russian diamonds by six months and added an important concession for goods that predate the rules.

The traceability programme for imports of rough and polished natural diamonds will become mandatory on March 1, 2025, and not on September 1, 2024, the EU said.

This follows calls by De Beers and other industry figures to extend the interim period, during which importers may use other documentation to show that diamonds are not Russian.

Once that period is over, importers into the EU must use a traceability-based certification scheme to verify imports of diamonds over 0.50 carats.

The EU has also added a ‘grandfathering’ clause to exempt diamonds that were located in the EU or a third country other than Russia or were manufactured in a third country, before the rules went into effect. The EU ban on direct imports of diamonds from Russia began on 1 January 2024, while the ban on goods transformed outside Russia started on 1 March-Rapaport.