Martin Endjala

The Government Institutions Pension Fund (GIPF) has recorded an increase in its asset value of N$151 billion for the 2023 financial year, compared to N$147 billion recorded in 2022.

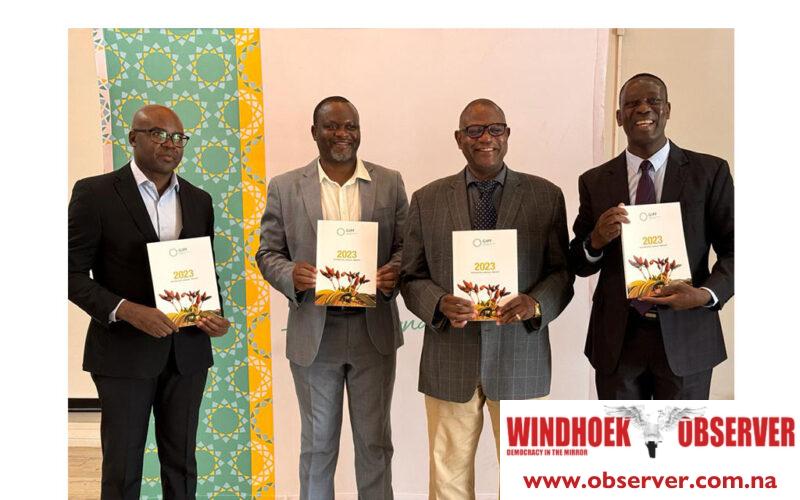

GIPF’s Chief Executive Officer, Martin Inkumbi announced this during the launch of the integrated annual report year ended 31 March 2023.

Inkumbi said the Fund’s investment return has increased by 7.7 percent to N$6.5 billion, compared to an increase of 10.8 percent (N$11.6 billion) in the prior year.

Adding that the increase is attributed mainly to favourable investment returns during the period under review.

The Fund has N$110 billion in investments managed by investment managers and N$1.9 billion in direct investments, with its treasury portfolio standing at N$38.5 billion. While investment reinvested stood at N$6.5 billion.

GIPF has committed a total amount of N$9.6 billion to unlisted investments in Namibia and has contributed N$6.9 billion to members’ benefits for the 2023 financial year compared to N$5.5 billion in 2022, which translated into a 25 percent increase.

Inkumbu indicated that the Fund has spent over N$2 million on strategy-driven training and development for staff.

GIPF Board of Trustees, Vice Chairperson Evans Maswahu, emphasised that GIPF has produced integrated annual reports since 2018 to enhance the way they communicate the business narrative, providing a coherent account of how all of its resources contribute to value creation.

To this end, Maswahu said GIPF has consistently upheld the core principles of good governance, accountability and transparency for over the last 33 years.

“As we proudly present our sixth integrated report, we continue our tradition of reviewing GIPF’s strategy direction, business model, risks and opportunities, and operational and governance performance,” said Maswahu.

The report Maswahu said, highlights the final year of the Strategic Plan for the period 2018 to 2023, which was developed around four strategic themes to ensure that the Fund manages its affairs.

The Fund currently has 97 512 active members and 49 197 active monthly pensioners. It also recorded a monthly contribution received of N$4.7 billion.

Its reporting process aligns with the principles and standards outlined in the International Financial Reporting Standards, the Integrated Reporting Framework established by the Value Reporting Foundation, the Namibian Code of Corporate Governance (NamCode), and the 2016 Report on Corporate Governance for South Africa.