The Bank of Namibia has announced significant changes to the banking industry, which could have profound consequences for the sector. These changes include the implementation of the Banking Institutions Act and the Payment System Management Act.

Under the new regulations, Namibian banking institutions are required to establish independent and autonomous boards, implement term limits, and set age restrictions to prevent board members from serving indefinitely. Additionally, the central bank has mandated that all credit decisions and approvals must be made by individuals authorised by the Bank of Namibia, and no credit decisions should be made outside Namibia by unauthorised persons.

Furthermore, the new regulations empower the Minister of Finance and Public Enterprises to establish rules governing the fees and charges imposed by banking institutions on their customers. The central bank will also closely scrutinise and prohibit profit shifting and transfer pricing practices facilitated through service level agreements with parent institutions.

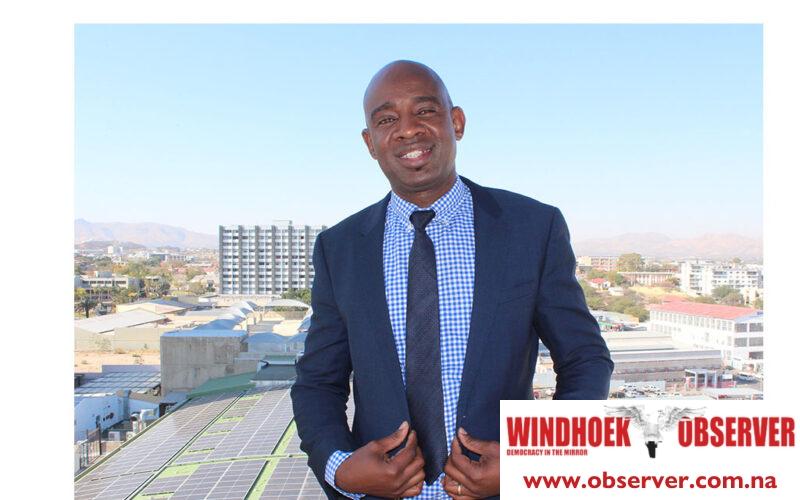

To gain insights into the banking industry’s reaction to these changes, Observer Money conducted an interview with Brian Katjaerua, CEO of the Bankers Association of Namibia.

Observer Money (OM): What is the industry’s reaction through BAN to the call by the Bank of Namibia for a responsive banking industry as new laws take effect?

Brian Katjaerua (BK): We believe as banking industry that we have been, and are responsive in the interest of the Namibian economy and the consumer. Our vision is ‘to contribute to the sustainability of banking and the socio-economic development in Namibia.’ Well entrenched in this vision is to have regard to all our stakeholder’s interests, and to deliver value and products unique to each stakeholder’s circumstances. We will continue to do so, and will continue to improve where there are legitimate calls for improvement.

OM: What is the industry’s view on the implementation of the Banking Institutions Act and the Payment System Management Act?

(BK): BAN members are committed to compliance with all laws passed through the legislative process of the country, as per the Namibian Constitution. Therefore, BON and Parliament, are within their constitutional rights to pass laws to regulate banking activities. Where we find challenges of compliance, there are mechanisms and processes in place to address these with our regulators view a view of finding solutions that are in the best interest of banking and the country.

OM: When are banks expected to have independent and autonomous boards?

BK: Our view has always been that banks have independent and autonomous boards, appointed in line with the law and principles of corporate governance.

OM: BoN also said no credit decisions should be taken outside Namibia by persons neither authorized nor found as fit-and-proper by the bank to run the affairs of a Namibian banking institution, what will be the role of South African shareholders in FNB Namibia, NedBank and Standard Namibia?

BK: This question must be referred to BON as the author of the statement you are referring to.

OM: The new Banking Institutions Act has also introduced a provision empowering the Minister of Finance and Public Enterprises to make regulations relating to fees and charges imposed by banking institutions on their customers. What is BAN’s comment on this?

BK: We don’t have any basis to not comply with a law lawfully passed at this stage.

OM: The Bank of Namibia will not entertain profit shifting and transfer pricing practices, which are done via Service Level Agreements with the parent institution. What is BAN’s comment on this?

BK: We believe commenting on this is premature at this stage, and again, we prefer not to comment on matters raised by BON against banks in the public domain.