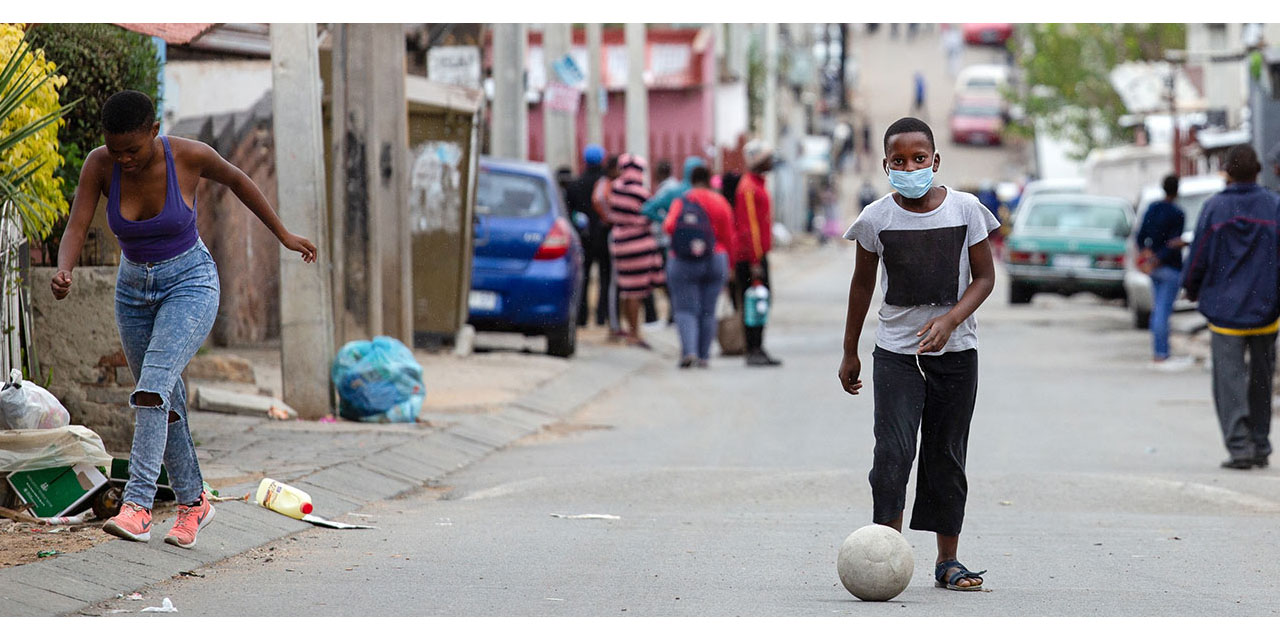

Low-income countries face multiple economic challenges, including rapid inflation, food insecurity, costly borrowing, and mounting debt, heightened by shocks from the pandemic and Russia’s war in Ukraine.

As a result, the IMF has revised down its growth projections for low-income countries, where per capita income growth is falling further behind the rates needed to catch up with advanced economies. This threatens to reverse a decades-long trend of steadily converging living standards.

To boost economic growth and put them back on a path to income convergence with advanced economies, we estimate that low-income countries need an additional US$440 billion of financing through 2026 from all available sources. As part of this, IMF concessional financing offered at low or zero interest rates will play a key role in helping these countries cushion the impact on growth from ongoing shocks and future crises.

The benefits of such financing were visible during the pandemic, when IMF-funded economies, on average, saw stronger, faster recoveries than unfunded counterparts, based on readings across three indexes tracking economic activity. Two of these are nontraditional metrics: Google Mobility Reports, drawn from smartphone location data, and nighttime satellite imagery, obtained from the Earth Observation Group. The third combines conventional economic indicators like gross domestic product, industrial production, and tourist visits.

IMF funded countries posted a faster and more robust recovery from the pandemic across a range of economic activity indicators compared to unfunded countries.

Our study, among the first to gauge the effects of IMF COVID-19 lending, showed the strongest gains in the poorest and more vulnerable recipients of concessional financing.

This study comes after more than US$272 billion in support to 94 of our 190 member countries since the start of the pandemic, including US$34 billion in emergency financing. Our conclusions hold when we control for a range of country characteristics, including income levels, pandemic severity, lockdown intensity, and other multilateral financing.

The findings also indicate that these effects are larger in low-income countries with interest-free borrowing from the Poverty Reduction and Growth Trust (PRGT), the IMF’s tried-and-tested vehicle to provide concessional financing to its poorest and most vulnerable members.

Overall, the evidence suggests that PRGT concessional financing can have greater positive effects on low-income countries, partly due to their more constrained policy space and limited access to international credit, compared to advanced and emerging market countries. This underscores the importance of keeping the PRGT adequately financed, so it can continue to provide strong support to low-income countries for years to come. -IMF