Staff Writer

The upheaval of geopolitical developments across the world has created so much uncertainty requiring increase need for scenario planning tools to assist organizations navigate through the complexities of the global economic system.

This was collectively agreed to at a recent Rand Merchant Bank (RMB), a division of the First Nation Bank, event to consider competing views of the future under the banner of MB Future Events.

The event which was held in collaboration with the Economic Association of Namibia (AN), the Hanns Seidel Foundation (HSF), Cirrus Capital and the South African Centre for Risk Analysis discussed the final report on Namibian Future Scenarios.

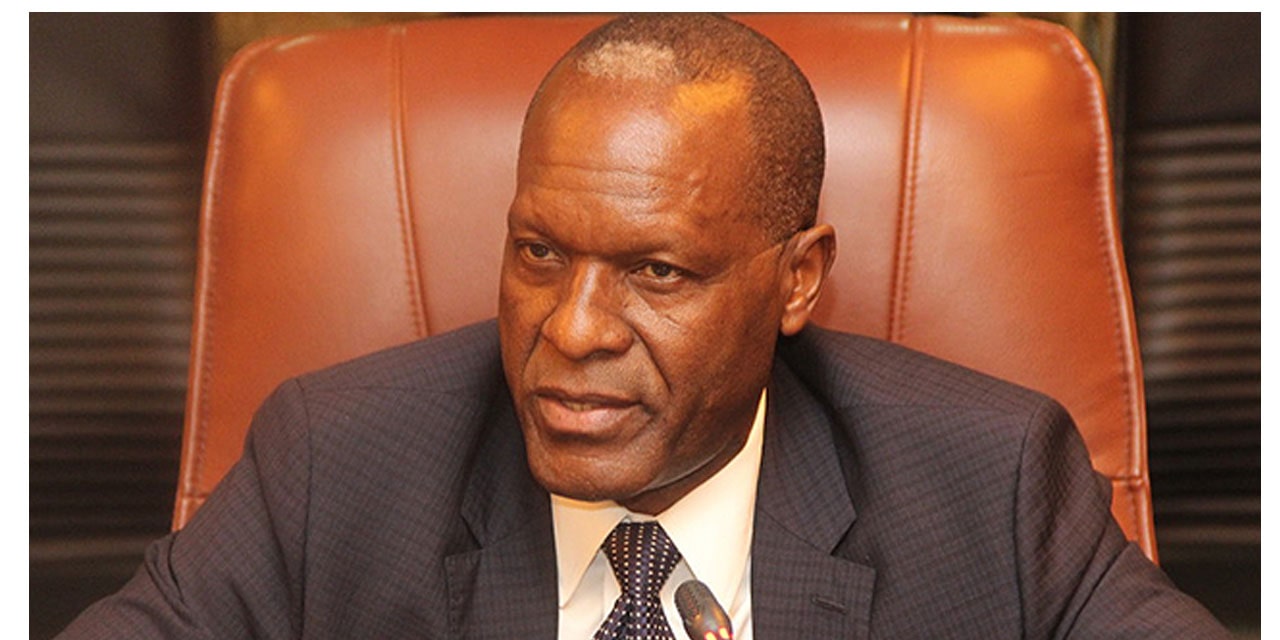

Minister of Mines and Energy, Tom Alweendo, said “the concept of scenario planning is not new but remains a useful framework to purposefully think about the prevailing socio-economic issues and their implications for the future of Namibia”.

The central question around which the scenarios were developed was, ‘’will 90% of Namibians be in gainful employment by 2030?” with the scenarios identifying the factors that would contribute to or hinder that most desirable outcome.

Rowland Brown, the co-founder of Cirrus Capital during his presentation of the final report to the audience comprising of business leaders and economists said: “We identified 134 trends and

grouped these into twelve key driving forces which were then ranked in terms of their impact and uncertainty in order to develop all-encompassing scenarios.”

Dr Frans Cronje, previously of the South African Centre for Risk Analysis who also played a critical role in structuring the methodological approach to the report emphasized the fact that Namibia is strategically located and has great potential to attract foreign investments.

“However, this will be highly dependent on its ability to reform, embrace youth aspirations and leverage on oil discovery and green developments, to mention just a few,” said Cronje.

Sepo Haihambo, the Executive Officer for FNB Commercial sentiments were that commercial banks have an important role to play in the transformational journey of building a globally competitive Namibia through intermediating capital from savers to borrowers in a commercially sound manner.

“The ability for the private sector to initiate and build coalition with government to develop new viable industries presents an opportunity to promote entrepreneurship and sustainable business

Hubs,” concluded Daniel Motinga, the Head of Public Sector Banking at RMB/FNB.